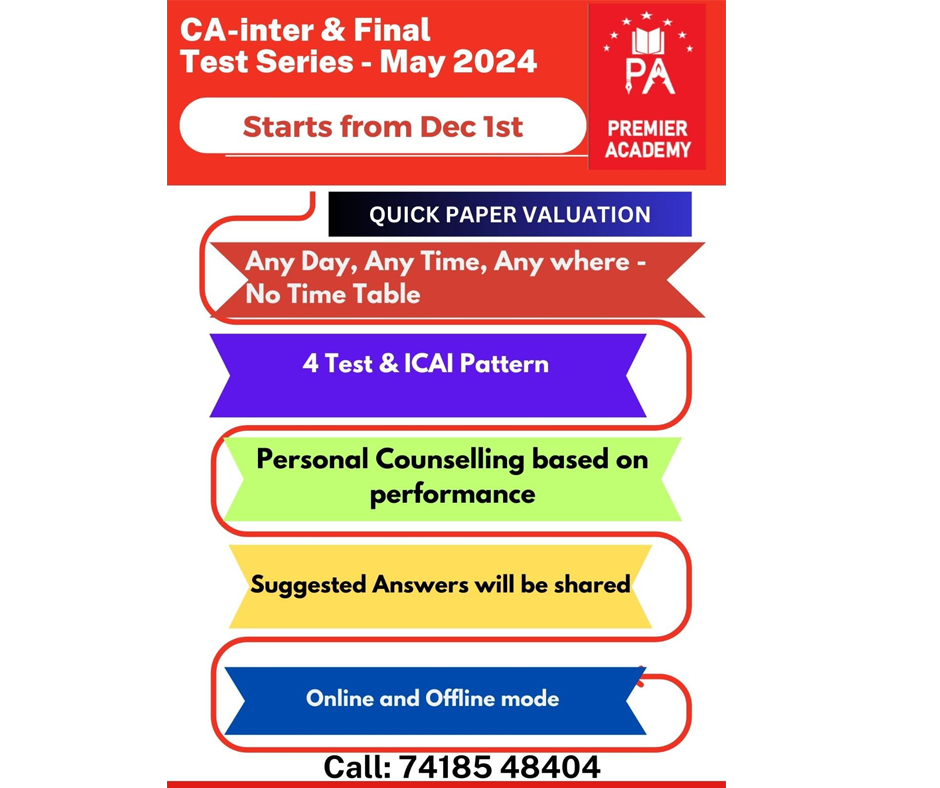

We make the student write model exams and

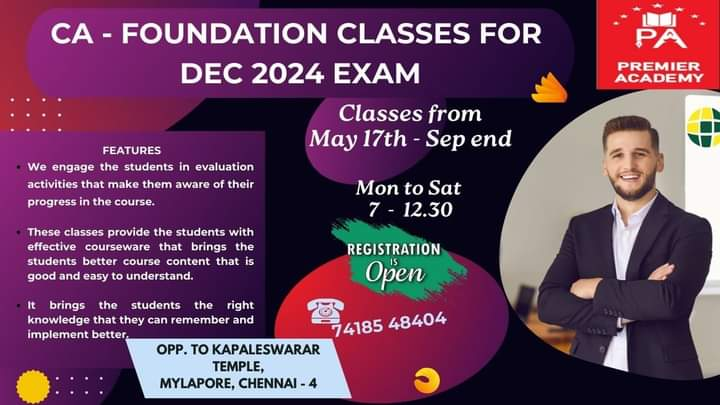

How many times you refer ONE particular book is more important than how MANY books you refer.